Is biotech losing its best talent to AI?

The right technical people can be a huge competitive advantage in industries like biopharma. The challenge becomes attracting and retaining that talent, both on a per-company level and industry-wide, especially when there are more lucrative alternative opportunities at hand.

A tweet crossed our feed recently from someone who left biotech for (non-bio) AI:

"There's an exodus of talent from biotech to AI, myself included, and many friends. Bio needs far more paths for ambitious young people that don't want to get underpaid or capped on growth."

The "capped on growth" phrase is interesting. It's easy to dismiss the biotech-to-AI migration as people chasing the hot new thing, drawn to flashier companies with bigger budgets. That's part of it. But "capped on growth" suggests something deeper about how biotech companies are structured and what they can offer talented technical people.

This matters because biotech needs to attract ambitious young talent. The field solves meaningful problems. Working on therapies that could cure diseases is inherently more impactful than optimizing ad engines or building consumer apps. That should be a competitive advantage in recruiting. But if structural issues are driving away the people who could push the field forward, we need to understand what's actually broken.

What does "capped on growth" actually mean?

The phrase could mean several different things, and all of them are probably true to varying degrees, for different people.

For some, it means showing up eager to do cutting-edge ML work and spending most of your time on data plumbing. Biotech companies often haven't solved basic infrastructure problems. The most fundamental issues around data access, structure, and quality remain unsolved. Talented ML engineers join expecting to build sophisticated models and instead spend months navigating dead links, cleaning messy datasets, and dealing with the reality that the exciting technical work can't happen until someone fixes the basics.

We've seen this with larger companies that raised significant funding for AI initiatives. They hired strong technical talent with big budgets, then discovered their teams were stuck doing infrastructure work instead of the sophisticated modeling they were hired for. That's frustrating for people who joined specifically to work on interesting technical problems.

For others, "capped on growth" might mean limited progression paths. If you join a biotech to do computational work and the company doesn't take that function seriously, there aren't senior roles to grow into. You might be technically excellent but have nowhere to advance because the org chart doesn't reflect computational work as a critical function.

There's also resource constraints. If you want to work on ambitious ML projects and need significant compute resources or infrastructure investment, most biotech companies can't compete with what AI companies offer. You're not just paid less, you have access to fewer tools and resources to do your best work.

Perhaps most significantly, computational work often becomes a second-class citizen in biotech companies. Even companies that initially positioned themselves as AI-driven platforms faced market pressure to focus on asset development. When the funding environment shifted a few years ago, investors started asking "where are your assets?" instead of "how impressive is your platform?"

That created an identity crisis. Companies that hired computational talent with the promise of building groundbreaking AI platforms suddenly had to prioritize near-term asset development. The ML work became secondary. For someone who joined to push the boundaries of computational drug discovery, finding yourself consistently deprioritized in favor of more traditional drug development is a legitimate reason to look elsewhere.

The structural compensation problem

The Life Sciences field has deep structural issues around how it compensates people, especially early in their careers.

Off the bat, the academic pipeline creates badly calibrated expectations. Many biotech scientists come through academic training where postdocs might earn $50k annually despite having a PhD and years of specialized training. This creates a warped sense of market value. Someone finishing a postdoc might not realize that entry-level positions in other technical fields pay double that amount for people fresh out of undergrad.

This academic conditioning means biotech companies can underpay relative to talent level, and people accept it because it seems normal within the field. But when someone realizes they could earn significantly more doing adjacent technical work in AI, the comparison becomes stark.

The equity situation compounds this. Biotech companies typically offer much smaller equity pools than tech companies. Part of this stems from funding models. Many biotechs emerge from incubators or get early funding from large institutional investors who take significant ownership stakes before the company is even fully operational.

We’ve all heard about these models, where the incubators take up to 80% ownership at the very first investment of capital. At that point, the founders have given up 80% of their company, before they know if their idea will actually pan out, before they can hire anyone, before they've raised an externally-validated round. This leaves founders with a very small amount to split among themselves and all future employees, and that's not counting whatever gets diluted in subsequent raises. Early employees at these companies receive equity packages that represent tiny absolute ownership because so much was already given away.

The risk-reward calculation becomes hard to justify. You're joining an early-stage company with all the same startup uncertainty, but your equity upside is dramatically smaller than if you joined an equivalently early tech company. Same risk but with a fraction of the potential upside.

Tech workers have normalized certain compensation expectations. There's a well-understood framework: higher risk should mean higher potential returns through equity. Biotech breaks this framework. High risk, minimal equity, below-market cash compensation, all while requiring equivalent or higher levels of technical sophistication.

The impossible balance

Biotech faces a challenge that doesn't have an obvious solution. The field needs to attract ambitious young talent. That requires making careers in biotech exciting, well-compensated, and full of growth potential. You need to inspire high school students to pursue the training required for biotech careers, then convince them to actually enter the field rather than taking their biology and chemistry knowledge into adjacent industries.

At the same time, the industry can't afford another hype cycle. Too many companies raised too much money on inflated promises four years ago. When those promises didn't materialize on expected timelines, the resulting market correction has been severe. Biotech remains in a prolonged downturn even as other sectors, particularly AI, are booming.

The field needs to be grounded in realistic timelines and expectations. Drug development is genuinely hard and takes time. Promising breakthrough platforms and delivering incremental improvements creates a credibility gap that affects the entire industry. But being too conservative makes it impossible to compete for talent against industries that can offer faster iteration cycles, quicker paths to visible impact, and frankly, much better compensation.

This tension doesn't have a clean resolution. You can't just pay everyone tech salaries and give tech-sized equity packages while maintaining viable biotech business models. You can't promise that every computational role will work on cutting-edge ML rather than necessary but less exciting infrastructure work. You can't guarantee that market pressures won't force pivots that change what roles look like over time.

What actually needs to change

Some things could improve without requiring wholesale transformation of how biotech works:

- Companies could be more honest about what computational roles actually entail. If someone is going to spend their first year fixing data infrastructure rather than building sophisticated models, say that upfront. Some people will still be interested in solving those problems. Others won't, and that's fine. Mismatched expectations hurt everyone.

- The academic-to-industry pipeline needs recalibration around compensation. People shouldn't leave their postdocs thinking $60k is a good salary for someone with a PhD and specialized skills. Better calibration would help both retention and give people realistic expectations about their market value.

- Equity structures need rethinking, particularly around early ownership dilution. The model where institutional investors or incubators take huge ownership stakes for minimal capital creates downstream problems for everyone who joins later. Those structures made sense in an era when biotech was more capital-intensive upfront, but computational drug discovery has different economics.

- Perhaps most importantly, companies need to think carefully about how they position computational work. If it's genuinely central to the strategy, resource it accordingly and maintain that prioritization even when market pressures push toward asset focus. If it's a supporting function, be clear about that from the start rather than creating expectations that won't match reality.

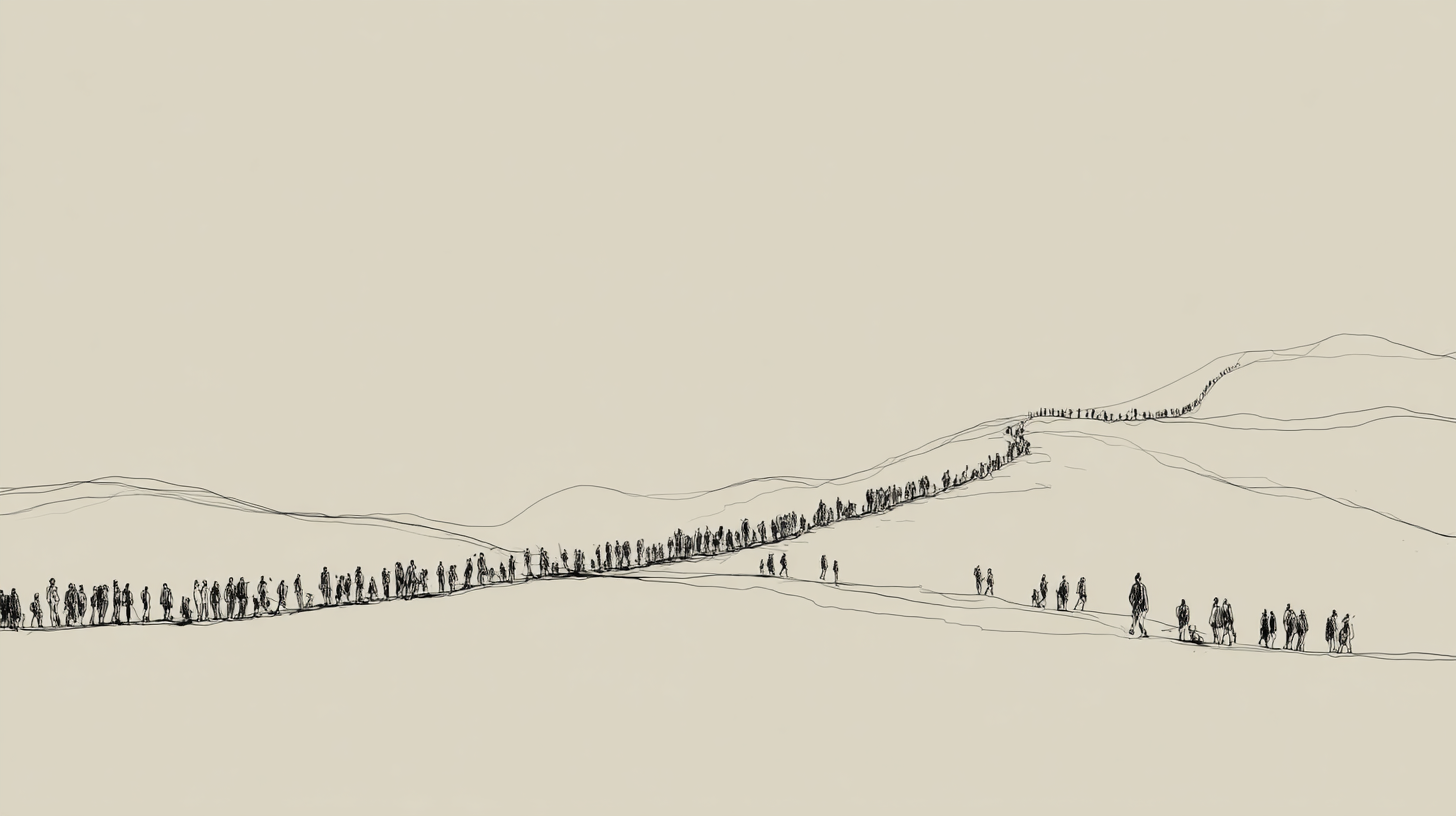

The exodus to AI (if you believe it’s happening) reflects real structural issues in how biotech companies are built, funded, and operated. Some talented people will always choose biotech despite these issues because the mission matters to them. But relying entirely on mission-driven motivation while asking people to accept significantly worse compensation and career prospects has natural limits.

The field does genuinely important work. Getting that work done requires attracting people capable of doing it. Right now, biotech could be losing too many of those people to industries that might be less meaningful but offer clearer paths for ambitious talent to grow, contribute, and be rewarded accordingly.

Kaleidoscope is a software platform for Life Science teams to robustly manage their R&D operations. With Kaleidoscope, teams can plan, monitor, and de-risk their programs with confidence, ensuring that they hit key milestones on time and on budget. By connecting teams, projects, decisions, and underlying data in one spot, Kaleidoscope enables R&D teams to save months each year in their path to market.